Menu

Ignite your Startup

Partner with us to transform your vision into reality, leveraging our resources, network, and expertise for your startup's success.

Accelerator

Startup growth with funding, mentorship, and networking opportunitie.

M&A

Strategic busines to enhance capabilities, reach, and market share. Provided by the NETZSCH Groups M&A department.

Open Innovation

Collaborative idea exchange to propel innovation and develop cutting-edge solutions.

Incubation

Nurture fledgling startups with support services, guidance, and early-stage funding.

Investments

Allocating capital to opportunities aligned with strategic goals for growth and innovation.

Cooperations

Synergistic partnerships for shared success through joint ventures and collaborative projects.

B2C Ventures

We usually do not engage in direct-to-consumer markets, focusinginstead on B2B and digital business models

Speculative Investments

Speculative, high-risk ventures without a clear strategic fit purelyfor financial return, are outside our criteria

Stand-alone Investments

We do not engage in purely financial investments that lack a collaborative approach or synergy

Silent Partnerships

Our investments are hands-on; we seek active engagement rather thansilent financial contribution

How we work

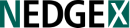

Food and Agricultural Innovation

Example: Alternative Proteins

Manufacturing and Robotics

Example: Industrial IoT, Robotics, Simulation

Digital Commerce and Marketplaces

Example: B2B Platforms / eCommerce

Sustainable Technologies

Energy Solutions, Recycling, Micro Plastic Separation and Filtration

Material Science and Engineering

Example: Alternative Materials

Life Sciences and Pharmaceuticals

Example: Pharma & Life sciences

AI and Analytics

Example: AI, GPT, Inline-analytics and Process intelligence

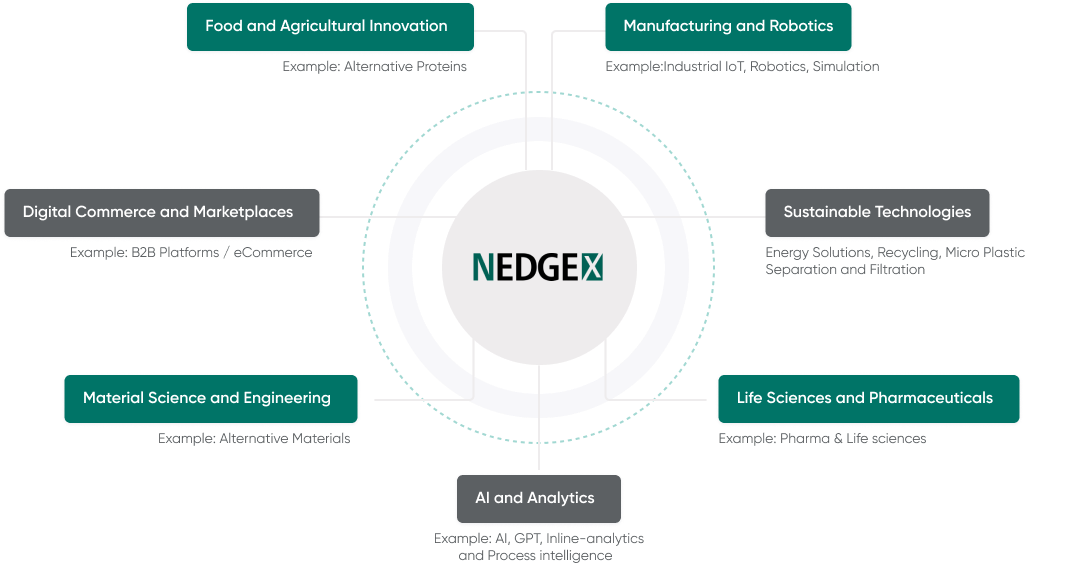

Worldwide Reach:

Our expansive global operations and sales network ensure access to diverse markets and opportunities.

Ecosystem Integration:

Unlock potential with direct access to our robust network of ecosystem partners.

Strategic Investment:

Secure capital invest-mentoptions from seed stage to joint ventures to fuel your growth.

Collaborative Innovation:

Jointly develop state- of-the-art products and processes that set new industry standards.

Specialized Services:

Take advantage of our toll services in Grinding & Dispersing as well as Analysis & Testing.

Advanced Equipment:

Benefit from cutting-edge equipmenttailored to enhance your operational efficiency.

Decades of Mastery:

Leveraging a 150-year legacy in capex goods and business creation to deliver unparalleled expertise.

Financial Framework

Our financial engagement is structured around two core frameworks:

Investment

Ranging from €250K to €1M, potentially in equity or convertible formats. Supplementary investments are strategically paired with our expertise and resources.

Joint Venture

Structuring company growth collaboratively with one additional partner. Capital commitment up to €5M per partner, reinforcing our shared strategic vision.

What We Care About

What is rooted in our values:

Strategic Alignment:

Ventures that resonate with NETZSCH Group's mission and have the potential to drive significant advancements within our key sectors.

Early-Stage Ventures:

We focus on opportunities from the pre-founding stage up to the seed round, nurturing innovative ideas from their inception.

Collaborative Mindset:

Partners who are proactive, open to synergistic collaboration, and eager to engage in joint development efforts.

Expertise Fit:

Startups aligned with our areas of expertise, where NETZSCH Group's depth of knowledge and resources can greatly enhance success and innovation.

Long-Term Thinking:

Seeking enduring success, weprioritize long-term, win-win partnerships over quick exits, ensuring mutualgrowth and lasting impact within the industry.

Testimonials & Recognitions

What people in our ecosystem have to say about us

Tobias Rappers

MD MASCHINENRAUM, Berlin

"The NETZSCH Group is one of the more valuable companies in the mid-sized business ecosystem."

Dr. Alexander Chaloupka

CEO SENSXPERT (NETZSCH spin-off)

“A safe space from the idea to the spin-off- Thanks to unfair advantages and methodological competence.“

Toni Drescher

CEO INC Innovation Center, Aachen

"On the right setup on the way to becoming aWorld Class Innovator.“

Dr. Martin Mittermeier

VIESSMANN VC

"Compelling approaches and professionalism in the corporate venture capital environment."

Robert Rosen

CEO & Kunde, Augsburg

"Solutions with added value for secure management of our laboratory and production data.“

Christian Werner

Student, Top-Talent & High Potential

"Here, I can liveout my passion, incredible opportunities, and everything is high-tech.“